(And Why Adjusters Are Winning More With Aerial Imagery in 2025)

When insurance carriers push back on a claim, one of the first things they challenge is causation: “Was this damage really caused by the storm… or was it pre-existing?”

Public adjusters, roofers, and attorneys know this game all too well. But in 2025, there’s a tool that flips the conversation on its head:

Historical aerial imagery.

With access to 9+ years of property photos, taken at multiple points in time, you can prove exactly what the home looked like before the event — and what changed after. No guesswork. No debates. No carrier narratives.

Let’s break down how you can use historical aerial imagery to build bulletproof claim files, win more supplements, and dramatically increase settlement accuracy.

What Is Historical Aerial Imagery?

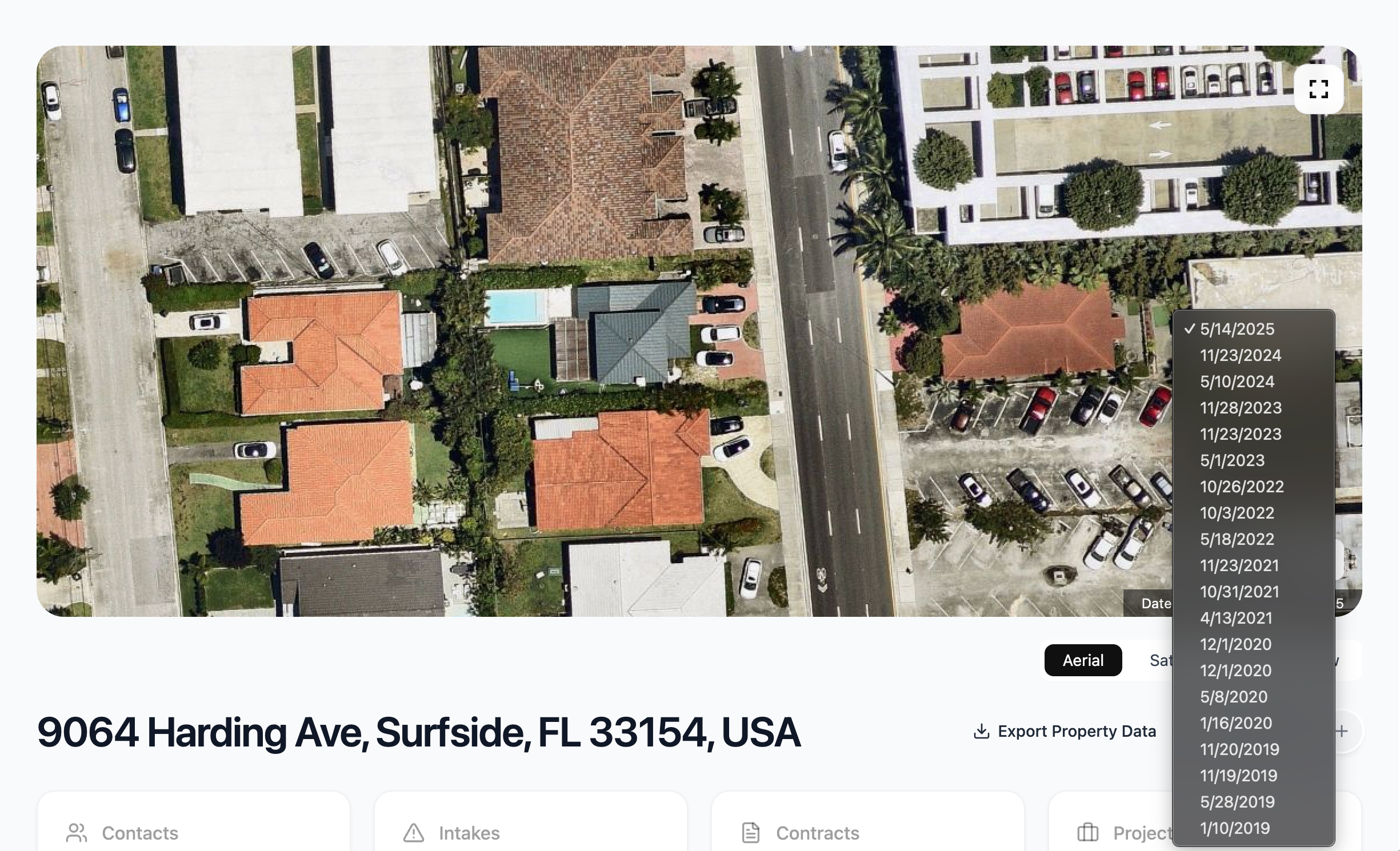

Historical aerial imagery is a series of high-resolution photos captured from above — typically by airplanes, drones, or satellites — showing a property at different points in time.

Think of it like the time machine every adjuster wishes they had.

With platforms like Drodat, you can instantly view:

This lets you verify — or shut down — carrier arguments instantly.

Why Carriers Care So Much About “Pre-Existing Damage”

Before we get tactical, understand the carrier’s playbook:

Insurance companies LOVE to blame pre-existing damage because:

But with historical aerial imagery?

You now have objective, timestamped proof of the roof’s condition before the loss.

Carriers hate it. Adjusters love it. The truth wins. 😌

5 Powerful Ways to Use Historical Aerial Imagery to Strengthen a Claim

1. Proving “Sudden and Accidental” Damage

Was the roof clean in 2018… and suddenly damaged after a 2023 storm?

Historical imagery makes it obvious.

You can show:

Then compare it to post-loss Drodat inspection photos for a rock-solid argument.

This instantly establishes causation.

2. Refuting Carrier Denials

When a carrier states: “Damage appears to be old, unrelated, or due to wear and tear.”

… you pull up imagery from previous years showing a healthy, intact roof. Boom. The narrative shattered.

You’re not arguing anymore — you’re presenting visual evidence.

3. Supporting Supplements & Higher-Value Estimates

Imagine you’re pushing for:

Historical imagery helps show the roof was not previously damaged, proving the new damage came from the event — not long-term decay.

Better evidence → stronger supplements → larger settlements.

4. Identifying Prior Repairs or Alterations

Historical imagery shows:

This helps you build a cleaner timeline — and prevents surprises during negotiations.

5. Speeding Up Claim Validation

Carriers often delay claims by asking for:

With aerial imagery, you give them all of it in minutes — including timestamps from multiple years.

Faster proof = faster settlements.

Bonus: Spotting Issues Homeowners Don’t Notice

Homeowners rarely look at their roofs. Historical aerial imagery doesn’t miss anything.

You can discover:

This helps you scope the claim more accurately — and increases your credibility.

How Drodat Makes Aerial Data Instantly Useful:

Most companies give you a single photo. Some give you two. Drodat gives you full historical timelines — up to 9+ years back — with:

It’s evidence you can drop directly into:

It goes from “nice to have” → absolute weapon.

Final Thoughts: Historical Imagery Is the New Standard

If you want to win bigger claims, faster, and with less arguing…

Historical aerial imagery is now essential.

It turns disputes into proof. It turns denials into payouts. And it turns adjusters into absolute machines.

If you want to test the tool live:

👉 Start your free 14-day Drodat trial

or

👉 Book an interactive demo with our team

Let’s make your next claim your easiest one yet. 😏

About the Author

Jake Cox

CMO at Drodat. Passionate about helping people utilize tech to make their lives easier.